In the digital age, payment gateway development has become an indispensable element for any business that wants to deploy e-commerce activities effectively, from online retail, booking services, to digital financial platforms.

One of the big questions that businesses face is: should they build a payment gateway themselves (how to create a payment gateway) or buy a ready-made solution from a third party? Self-development gives businesses complete control over user experience and security, but also requires significant technical resources. Meanwhile, buying or leasing a service saves deployment time but may limit customization capabilities.

In this article, we will provide a detailed guide to payment gateway development, analyze the factors to consider when setting up a payment gateway, the technical process, the security standards to comply with, estimated costs, and strategic notes for businesses to choose the most suitable option for themselves.

Understanding Payment Gateway Fundamentals

Core Components of a Payment Gateway

Understanding core components is essential when developing payment gateway software. A typical payment gateway includes: a user interface for entering card information, a transaction processor for encrypting and transmitting financial data, a fraud detection system to ensure secure transactions to complete the payment.

How a Payment Gateway Processes Transactions

The payment processing process through a payment gateway usually takes place within seconds but includes many complex steps. When card data is entered by the user and payment confirmed, the system encrypts the data and sends a request to the issuing bank for payment ability. The result returned is either a transaction approval or a rejection. If approved, funds will then be transferred through an intermediary bank into the seller’s account. It is important to learn how to create an online payment system in which each of these stages will be fast and secure.

Popular Payment Gateway Types

At present, the three main payment gateway models available for consideration in cases of online payment system development are:

- Redirect Payment Gateway: Customers are redirected to an external payment site (like PayPal), which makes for simpler security for the business but disrupts the customer experience.

- Hosted Payment Gateway: Payment information is collected and processed on the server of the payment service provider, which allows businesses to integrate simply without managing sensitive data on their own.

- API-Based Payment Gateway: Transaction data is sent via the API directly from the business website or application to the payment server. This model provides a seamless experience and consistent branding but requires high technical skills in payment gateway software development.

The choice of the type of payment gateway will be made depending upon the size and security requirements, as well as the level of customer experience that a business desires during the creation of online payment systems.

Prerequisites for Payment Gateway Development

Before the payment gateway development can proceed, the businesses will have to carefully prepare for some important basic factors to ensure that the project is bound to succeed. The requirements below must be looked at particularly well while learning how to start a payment processing company.

Technical Infrastructure Requirements

To successfully deploy a payment system, businesses need to prepare a solid technology infrastructure that meets high performance and security:

Powerful servers are essential to manage heavy traffic and ensure quick processing:

- Data storage system meets high security standards.

- Broadband Internet, ensuring fast and stable access speed.

- Having automatic backups in place minimizes the risk of losing critical data.

- Handling more users requires a system that can adapt and expand seamlessly.

When conducting payment gateway development, ensuring infrastructure readiness is an important first step to help the system operate smoothly.

Development Team Expertise

A dedicated technical team is a key factor in the success of the payment gateway development process. The team needs to have:

- Robust back-end development skills are crucial, particularly for handling financial transactions.

- Deep understanding of secure encryption such as SSL/TLS, tokenization, encryption standards.

- Experience in developing robust and easy-to-integrate APIs.

- Understanding of payment processes and banking systems.

- Ensures fast transaction speed through optimized system performance.

If the business lacks internal staff, it is necessary to consider cooperating with healthcare mobile app developers or companies specializing in payment gateway software development to supplement resources.

Relationships with Banks and Card Networks

Creating a payment gateway demands strong collaboration with leading financial organizations:

- Signing contracts with acquiring banks.

- Establishing links with major card networks such as Visa, Mastercard, American Express.

- Meet technical requirements and comply with security standards set by financial partners.

This is a fundamental step that any business wishing to how to start a payment processing company should prioritize early implementation.

Compliance with Legal Regulations

When participating in the payment market, compliance with security and legal standards is a mandatory condition:

- PCI DSS compliance: Must meet standards to securely process payment card data.

- Anti-money laundering (AML) policy: Apply transaction monitoring processes to prevent illegal financial activities.

- Know Your Customer (KYC): Collect and authenticate customer information to ensure transparency.

- Compliance with local regulations: Each market (e.g. US, EU, Asia) will have its own legal requirements that need to be updated continuously.

If this compliance factor is not ensured, any payment gateway development activity will potentially pose a huge legal risk.

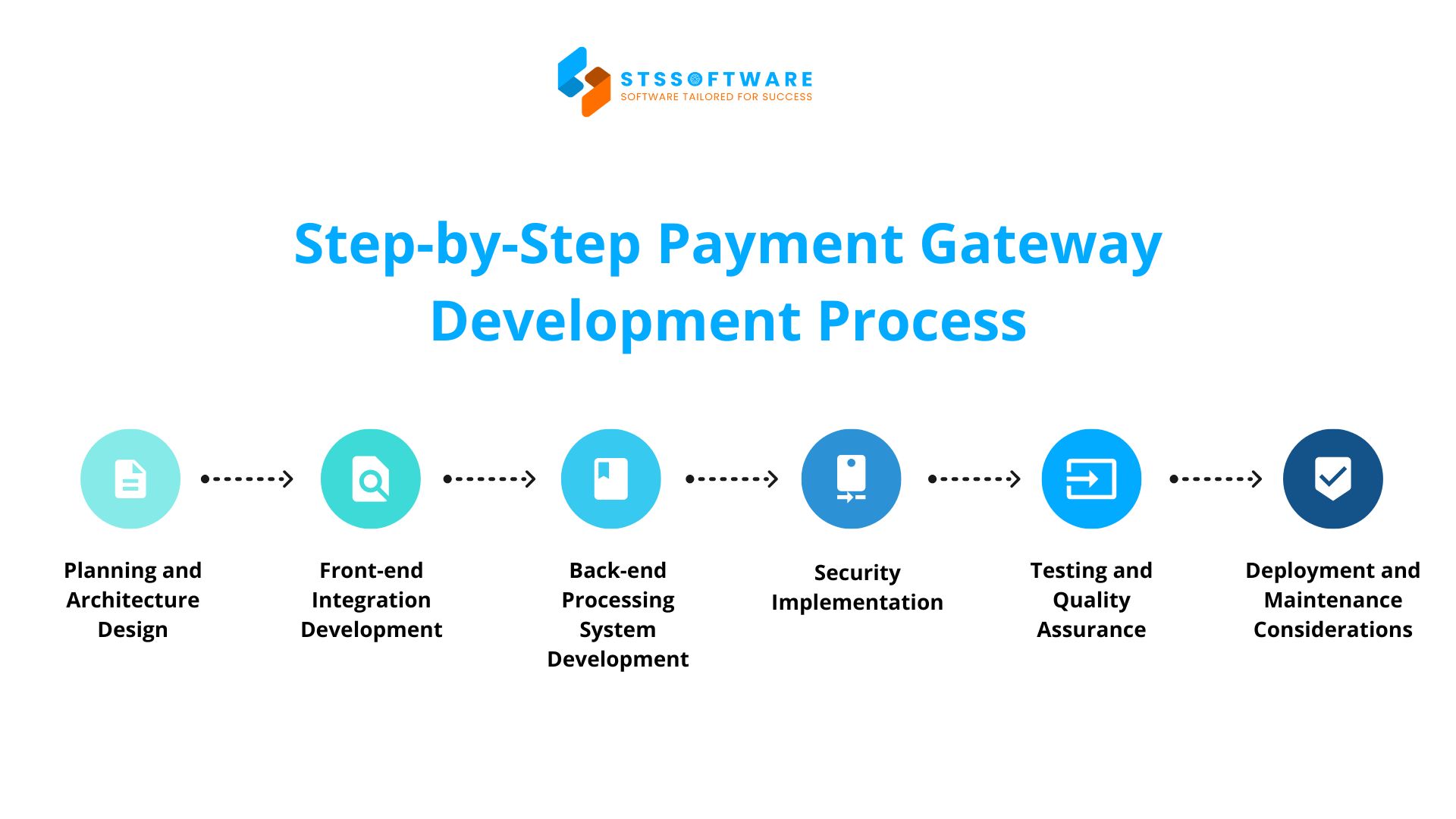

Step-by-Step Development Process

How to build a payment gateway not only requires high technology but also a clear and scientific development roadmap. A methodical process will help shorten the deployment time, optimize costs and ensure stable system operation. Below are the important steps in the process of building a payment gateway, applied by many successful businesses when developing a payment gateway.

Step 1: Planning and Architecture Design

The first step is to determine the needs, scope and design the appropriate system:

- Analyze market needs and functional requirements.

- Determine the overall architectural model, choose microservices or monolithic.

- Choose key technologies: programming languages, databases, cloud infrastructure.

- Build a detailed transaction processing flowchart.

A solid architectural foundation is a necessary stepping stone to ensure the payment system operates stably and securely.

Step 2: Front-end Integration Development

The payment interface needs to optimize the user experience:

- Design intuitive, user-friendly mobile and web interfaces.

- Develop secure payment widgets and buttons.

- Integrate API communication between the front-end and back-end systems.

- Ensure cross-platform compatibility (Android, iOS, Web).

Investing in the user interface will increase conversion rates and create trust for customers when paying.

Step 3: Back-end Processing System Development

The back-end plays the role of the “brain” in transaction processing:

- Design a transaction engine that ensures both speed and security during processing.

- Integrate with Acquiring Bank and card network.

- Process transaction authentication, anti-fraud and payment data storage.

- Create a system capable of generating transaction reports and analyzing data instantly as it’s received.

This is the part that requires extremely high accuracy and security in the process of building a payment gateway.

Step 4: Security Implementation

Information security is the top priority in developing a payment gateway:

- Apply end-to-end encryption.

- 2FA for users and administrators.

- Obtain PCI DSS compliance to align with globally recognized data protection requirements.

- Build a proactive fraud detection system.

If this factor is ignored, the system will face the risk of data leakage and loss of brand reputation.

Step 5: Testing and Quality Assurance

A full testing phase must take place prior to launching the system into real-world use:

- Functional Testing: confirm each feature behaves as expected and meets specifications.

- Performance Testing: evaluate processing speed under high load.

- Security Testing: detect and fix vulnerabilities.

- Compatibility Testing: on multiple devices and browsers.

A thoroughly tested product will minimize errors in actual operation.

Step 6: Deployment and Maintenance Considerations

After completing testing, a long-term operation and support plan is needed:

- Launch the system within a reliable and secure production infrastructure for consistent performance.

- Monitor real-time operations and log transactions fully.

- Update security periodically, patch bugs quickly when they arise.

- Continuously improve features to meet changing market needs.

Maintaining a good system will help businesses maintain their reputation in the payment industry.

Essential Features to Include

A successful online payment system requires the integration of many core features to ensure smooth, secure, and efficient operations. The payment gateway features below will help businesses build a custom payment gateway suitable for the increasingly competitive online payment system environment.

Transaction Processing Capabilities

The foundation of any online payment system is the ability to process transactions stably and quickly:

- Enable real-time transaction handling while keeping processing delays to a minimum.

- Support flexible refunds and cancellations.

- Ensure accuracy and scalability as traffic increases.

For example, Stripe processes more than 5,000 transactions per second with latency under 50ms, optimizing the payment experience for users (Stripe Scalability Case Study).

Multiple Payment Method Support

To increase conversion rates, a custom payment gateway should support:

- Payment by card (Visa, MasterCard, AMEX).

- E-wallets such as Apple Pay, Google Pay, PayPal.

- Domestic bank transfer, QR code.

For example, PayPal supports more than 100 currencies and more than 25 local payment methods (PayPal Supported Currencies).

Fraud Detection and Prevention Measures

Ensure transaction security:

- AI system to identify fraudulent behavior.

- Deploy 3D Secure 2.0 and OTP authentication.

- Transaction speed limit mechanism.

For example, Braintree uses Kount anti-fraud platform to reduce 98% of transaction fraud (Kount and Braintree Integration).

Robust Security Systems

To meet global regulations and secure user data:

- Full SSL/TLS encryption.

- Pursue top-tier. PCI DSS compliance.

- Implement tokenization for payment cards.

For example, CyberSource (Visa) fully complies with PCI DSS Level 1 standards, ensuring the safety of millions of transactions per day (CyberSource PCI Compliance).

Reporting and Analytics Functions

Business decision support tools:

- Analytical dashboards by day, week, month.

- Transaction success rate reports.

- Automatic alerts for cash flow irregularities.

For example, Adyen provides online analytics to help businesses track conversion rates and detect payment errors by specific markets (Adyen Insights).

User-Friendly Administrator Interface

Makes managing your payment system easier:

- Intuitive interface for transaction management.

- Flexible configuration and setup.

- Track transaction history and system errors.

For example, Razorpay Dashboard supports merchants to manage automatic refunds and detailed user permissions (Razorpay Dashboard Overview).

Compliance and Security Considerations

To build an effective and reliable secure payment system, the most important factor is not only speed or integration capabilities but also the ability to ensure data security and comprehensive security compliance. Modern payment systems are required to apply the highest security standards to protect user information, limit fraud risks and meet international legal requirements.

PCI DSS Compliance Requirements

The Payment Card Industry Data Security Standard (PCI DSS) is mandatory for all systems that process credit card data. To achieve compliance, businesses need to:

- Implement firewalls and tightly controlled network permissions to defend against unauthorized access.

- Encrypt cardholder data during storage and transmission.

- Perform regular security checks and keep access logs.

- Train employees on information security policies.

Data Encryption Standards

Encrypt all sensitive data encryption as a core requirement for maintaining information security:

- Apply AES-256 encryption to secure card data.

- Use SSL/TLS during data transmission.

- Limit access to encrypted data.

For example, Stripe uses TLS 1.2 and requires it for all APIs to avoid data leaks (Stripe Security Guide).

Apply Tokenization Technology

Tokenization replaces real card information with random, irreversible identifiers (tokens):

- Tokens do not contain real value, so if stolen, they cannot be used.

- Reduce the responsibility of storing original data for businesses.

For example, Adyen implements tokenization for all transactions to reduce the risk of data breaches (Adyen Tokenization).

Fraud Prevention Mechanisms

Solutions for fraud detection and prevention need to be tightly integrated:

- 3D Secure 2.0 for user authentication.

- AI-based user behavior tracking system.

- Blacklisting suspicious IPs and devices.

For example, Worldpay uses machine learning to prevent over 75% of automated fraudulent transactions (Worldpay Fraud Protection).

Security Audits and Testing

Regular security testing and assessments help detect potential vulnerabilities:

- Penetration testing.

- Automated vulnerability scanning with dedicated tools such as OWASP ZAP.

- Regular assessments by security certification bodies.

Integration Approaches

When implementing payment solutions, choosing the right integration method plays an important role in ensuring the system operates efficiently, stably and is easy to maintain. Below are common approaches and key considerations during the integration process:

Good practices when developing APIs

Building and maintaining payment gateway APIs should follow popular RESTful or GraphQL standards today, ensuring high security (e.g. using OAuth 2.0, JWT), scalability and detailed logging capabilities. A clear API documentation structure with specific illustrative examples helps reduce integration time for partners and third-party developers.

Considerations when developing Mobile SDKs

With the growing popularity of mobile applications, providing mobile SDKs makes it easy for developers to integrate payment functionality into their applications. SDKs should support multiple platforms (Android, iOS), provide flexible UI/UX, and ensure user data security (e.g., end-to-end encryption, no card information stored on the device).

Web integration techniques

Web integration techniques include methods such as embedding iframes, redirecting to the payment page, or using a JavaScript SDK. Choosing the right method depends on the user experience requirements, security, and the level of control the web developer has over the payment process.

Connecting to Third-Party Systems

In addition to building internal systems, many payment solutions need to integrate with other management systems such as ERP, CRM, or accounting systems. This requires flexible connectivity, possibly via API, Webhook, or message queue models, to synchronize data in real time and minimize errors.

Cost and Timeline Considerations

Before implementing a payment gateway solution, businesses need to carefully evaluate factors related to costs and implementation time to ensure investment efficiency. A detailed analysis of each item helps control the budget and plan in accordance with business goals.

Development cost analysis

Payment gateway costs include many components: user interface design and programming costs, backend construction, payment system integration, testing and security. In addition, hidden costs such as infrastructure costs (server, SSL, maintenance), software licensing or third-party service fees need to be taken into account.

Ongoing maintenance and operation costs

After the system is put into operation, businesses need to maintain a technical team to handle errors, update features, and ensure security. Annual maintenance typically represents 15% to 25% of the original development investment.

Estimated Actual Implementation Timeline

Development timeline depends largely on feature scope, system complexity, and stakeholder collaboration. Typically, a basic payment system can take 3 to 6 months to complete, while more complex projects can take up to 9–12 months.

ROI Analysis

Performing ROI analysis helps assess the profitability of the project compared to the costs incurred. Factors to consider include: increased revenue through improved payment experience, operational cost savings, and market scalability. A good project should have a clear payback period and a reasonable expected rate of return.

Alternatives to Custom Payment Gateway Development

Not every business needs or is suitable for building their own payment gateway system from scratch. Before deciding to create your own payment gateway, you should consider alternative solutions to save costs, shorten implementation time, and minimize operational risks. Here are some popular options today:

White-label payment gateway solutions

White-label payment gateways are an ideal choice for businesses that want to quickly own a payment system with their own brand without investing in the entire construction process from scratch. With this model, businesses use the platform available from the supplier, customize the logo, interface, and user experience as required.

API and payment gateway integration options

If businesses do not want to develop the entire thing themselves, they can use payment gateway solutions through API integration. Major payment gateways today provide powerful, easy-to-integrate APIs for both websites and mobile applications, supporting a variety of features such as multi-channel payments, card storage, or recurring payments.

Build vs. Integrate

The decision to build or integrate depends on the long-term goals of the business. Build-to-build offers full control, deep customization, and great profit potential, but requires a large investment in financial resources and technical resources. In contrast, integrating a ready-made solution allows for quick deployment, lower costs, and easy expansion according to initial needs.

Why Choose STS Software as Your Partner for Payment Gateway Development

When businesses are looking for a reliable partner to implement a payment gateway development project, choosing a company with extensive experience and expertise in the field of financial technology is a key factor to ensure success. STS Software is confident to be the top choice for the following reasons:

Extensive experience in financial technology development

As a leading fintech software development company, STS Software has many years of practical experience in building complex financial systems, from digital banks, e-wallets to international payment platforms.

Technical expertise in developing secure payment systems

STS Software’s engineering team has a solid foundation in data encryption, real-time transaction processing and sensitive information protection, ensuring that every custom payment solution meets the highest security standards.

Real-life successful projects in the payment field

STS Software has implemented many outstanding case studies such as implementing payment platforms for large retail chains, domestic e-wallets and international payment gateways, helping customers increase transaction revenue from 30% to 50% after only 6 months of operation.

Commitment to compliance and security

We strictly comply with international standards such as PCI DSS, GDPR and ISO 27001 in all payment gateway development processes, and are always proactive in updating new legal and security requirements.

Long-term support and maintenance capabilities

STS Software not only accompanies during the implementation phase but also commits to providing maintenance services, system upgrades, and 24/7 technical support throughout the product life cycle, ensuring stable operation and future expansion.

Conclusion

Implementing an effective online payment system not only helps businesses improve customer experience but also creates a competitive advantage in the market. To be successful in the process of creating a payment gateway, businesses need to clearly understand the key factors as well as a specific implementation roadmap.

During the process of learning how to set up a payment gateway, businesses need to pay attention to factors such as investment costs, implementation time, appropriate integration options (building your own or using an existing solution), security standards, and future scalability.

First, businesses should clearly identify their business needs and target customer groups, then choose the appropriate online payment gateway model (self-hosted, white-label or API integration). Next, find a reputable technology partner, make a detailed plan for the budget, timeline, and success criteria of the project.

The success of creating a payment gateway does not only depend on technology but also requires synchronization in business operations and development strategies. Therefore, businesses should prioritize solutions that are both secure and flexible to adapt to the rapid changes in the current digital payment market. In particular, choosing an experienced technology partner such as STS Software – a unit specializing in providing custom payment solutions and implementing international standard payment gateway development – will be a key factor to help the project achieve high efficiency, optimize investment costs and long-term operation.