Enter the digital era for finance, wherein technology is not only a support but something that reshapes the way finance operates. Among the cutting-edge technologies, artificial intelligence in finance is becoming a revolutionary factor. Such a way for AI in Finance helps financial institutions by means of intelligent data analytics and transaction automation to increase efficiencies, mitigate risks, and provide customized user experiences.

Henceforth, this article will discuss how AI in finance is helping in the finance transformation, along with practical application scenarios, distinctive advantages, and trends shaping the future of this entire domain.

The Current State of AI in Finance: From Experimentation to Implementation

Earlier, several financial institutions saw AI in finance as a somewhat novel experimental tool to be dabbled in through small projects or pilots. With time, however, financial AI demonstrated its worth and potential to prove itself, thus becoming a vital extension of the ordinary operations of the finance world.

Now, really large companies in the BFSI industry are not merely experimenting with AI in Finance; they have started their widespread deployment in key areas, including fraud detection, process automation, and customer service personalization. They’re also leveraging AI for data analytics and risk assessment, enabling faster, more accurate decisions. However, challenges like bias and discrimination remain, especially when AI models rely on skewed or incomplete data.

As per a survey of 2024 performed by PYMNTS, about 72% of the finance leaders who participated in the survey claimed to be applying AI into financial services in important areas such as fraud detection (64%), process automation (42%), and customer experience enhancement.

Internationally recognized AI applications have assisted financial organizations in minimizing their risk factors, saving costs, and optimizing operational efficiency. Data pattern recognition, analytics of customer behavior, and automation of processes & technologies have greatly increased business value in terms of credit assessment, risk management, and customer service.

Moving from experimentation to real-world deployment epitomizes the maturity of AI finance in the financial industry and its ability to drive the growth and innovation of the industry.

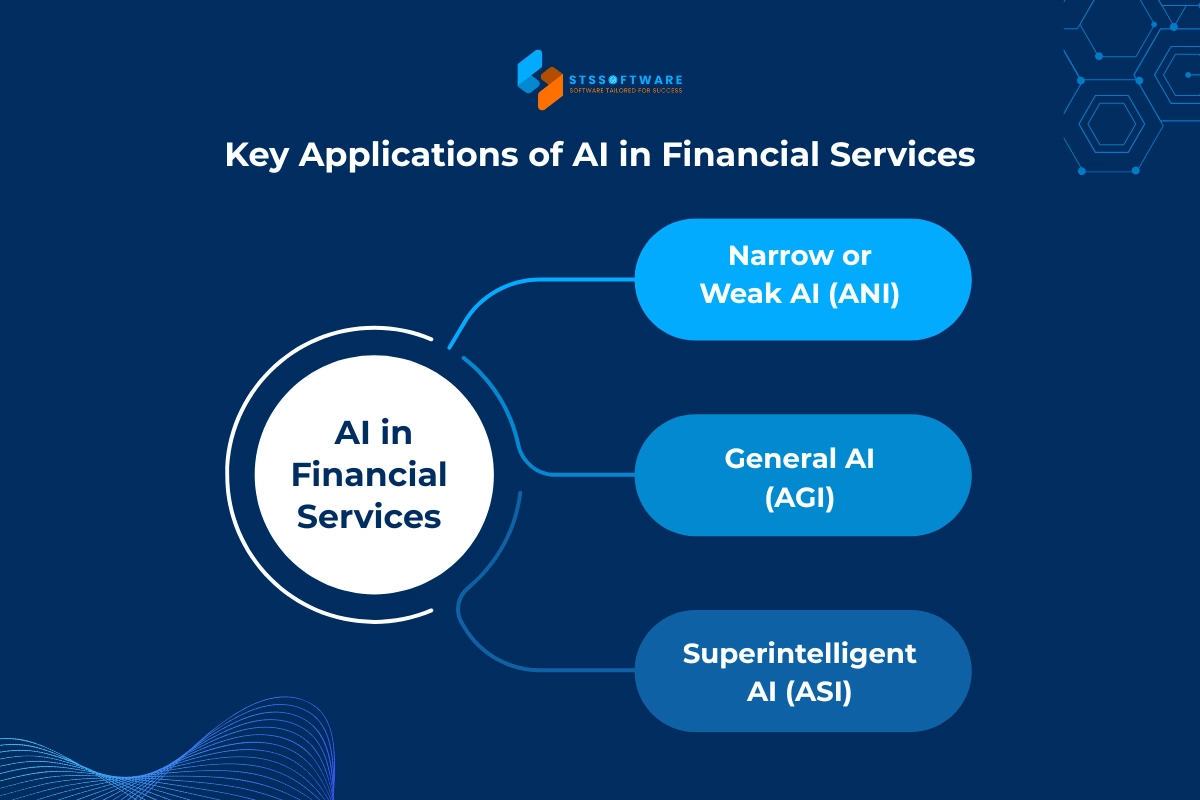

Key Applications of AI in Financial Services

AI-Powered Risk Assessment and Fraud Detection

With AI finance, financial institutions can make timely and accurate decisions related to credit risk management and fraud detection. Machine learning algorithms in finance AI help analyze user behavior, identify unusual patterns, and provide real-time fraud detection. This is a big step forward compared to traditional manual processes that financial ai is helping to effectively replace. In addition, AI also supports predictive analytics, helping to predict potential risks and support faster decision-making.

Automated Trading and Investment Management

AI for finance are helping to build algorithmic trading strategies based on market analysis and predictive analytics from historical data. From high-frequency trading to automated investment advice through robo-advisors, artificial intelligence finance is completely changing the approach to portfolio management and investing, helping financial institutions optimize performance and make faster decisions.

Customer Service and Personalization

Banks and financial institutions are now leveraging AI in finance to deploy chatbots and virtual assistants with natural language processing, which automate customer responses in a natural and efficient way. At the same time, personalized recommendation engines using customer segmentation and generative AI enable the creation of responses, content, and recommendations tailored to each customer group. These solutions not only help reduce the workload on customer service departments but also enhance user experience and build sustainable customer relationships through financial AI.

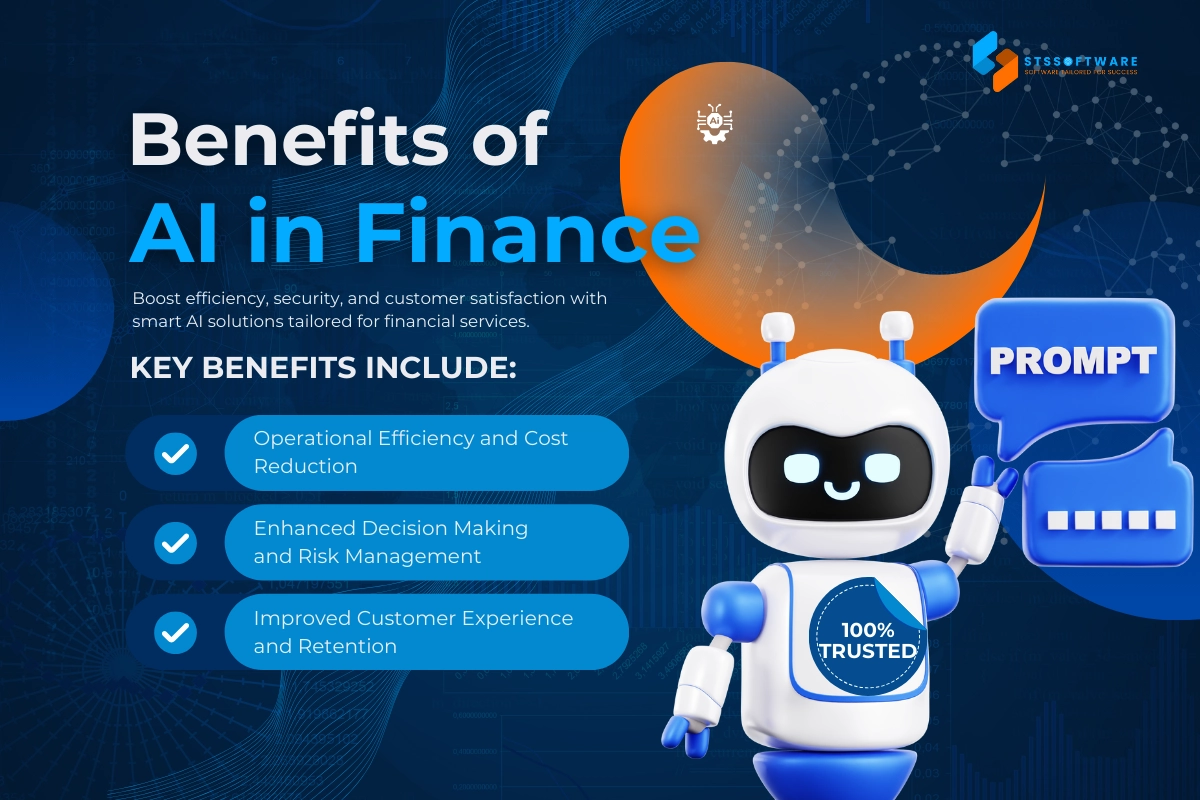

Benefits of Implementing AI in Finance

Some of the notable benefits of implementing AI in finance include:

Operational Efficiency and Cost Reduction

AI and finance help automate repetitive tasks such as document processing, data checking, or customer response. As a result, financial institutions can shorten processing times, minimize errors, and significantly save operating costs – a clear advantage of applying finance AI.

In addition, when integrating the system with third-party providers, ensuring information security becomes more important than ever. Thanks to AI applications, organizations can detect and prevent cyber-attacks in a timely manner, enhance security, and maintain operational stability.

Enhanced Decision Making and Risk Management

With a huge data warehouse, AI finance provides insights to help leaders make more accurate strategic decisions. At the same time, artificial intelligence in finance also supports risk analysis and prediction, thereby building effective and timely prevention plans.

Improved Customer Experience and Retention

Applying AI in financial services helps financial businesses provide personalized services according to the needs of each customer. Thanks to its speed, accuracy, and convenience, financial artificial intelligence contributes to increasing satisfaction, improving loyalty, and effectively expanding customer files.

Challenges and Considerations for AI Implementation in Finance

Data Quality and Integration Issues

One of the major barriers of AI in the finance industry is data that is scattered, lacks synchronization or does not meet the required quality. For finance AI to be most effective, organizations need to invest in a consistent, clean, and continuously updated data system.

Regulatory and Compliance Considerations

The application of AI in finance must strictly comply with legal requirements related to privacy, algorithm transparency, explainability, and ethical standards. As regulations on governance of AI in finance are constantly updated, financial institutions need to proactively build clear guardrails, coordinate closely with legal teams and compliance departments to ensure comprehensive compliance, and avoid possible legal risks.

Talent and Organizational Readiness

The absence of highly skilled human resources and the existence of an unsuitable organizational culture are the major stumbling blocks for organizations intent on deploying financial AI. To apply effectively, organizations need to build a comprehensive transformation strategy, combined with in-depth training for related departments such as auditors and internal control teams, thereby promoting proactive governance, ensuring compliance with ethics in processes such as credit scoring.

Future Trends: The Next Wave of AI in Finance

As AI technology continues to advance at a rapid pace, the financial industry is poised for the next wave of innovation, where trends like explainable AI, advanced predictive analytics, and ethics in technology will shape how financial institutions operate, make decisions, and serve customers.

Explainable AI and Ethical Considerations

As AI increasingly affects financial decisions, the need for transparency in the decision-making process becomes essential. Artificial intelligence finance will need to meet the requirement of “Explainable AI” and ensure the use of technology in accordance with ethical standards. This is also the focus of many organizations in the AI in finance industry.

For an artificial intelligence in finance to assess the type of loan application, it should be able to assert exactly why a certain applicant was either approved or denied. If a loan application evaluation appears to lack transparency, then customers and regulators may perceive it as biased or unfair.

Financial organizations are employing and allowing explainable AI models that provide detailed audit trails and explanations for every decision made, thus fostering accountability, avoiding discrimination, and complying with the European Union’s General Data Protection Regulation (GDPR). Companies are also beginning to create AI ethics committees and conduct bias audits regularly to promote the responsible use of AI in financial systems.

Advanced Analytics and Predictive Capabilities

AI is moving beyond analyzing current data to using deep learning models and big data to predict trends, powered by advanced computational power, to accurately predict future trends. This opens up a new era of new resources for AI and finance, in which artificial intelligence in finance will become a strategic tool to shape the future of the financial industry.

For example, a bank in Vietnam has applied artificial intelligence in finance to predict loan demand in each customer segment based on transaction history data, consumer behavior, and market trends. As an insight-driven organization, the system not only accurately forecasts when customers are likely to need loans but also recommends suitable loan packages before customers proactively contact them. This helps the bank increase the closing rate, improve customer experience, and optimize sales resources.

Why Choose STS Software as Your Partner for AI in Finance

With extensive experience in both finance and technology, STS Software is the ideal choice to accompany businesses on the journey of applying artificial intelligence in finance. We not only understand the actual needs of the industry but also build financial AI solutions suitable for each customer, ensuring that the AI finance system is always optimized according to each development stage.

Solutions designed according to the specific requirements of each business

Each financial business has different characteristics, so we always develop AI in finance systems based on the specific needs of each partner. STS Software does not provide mass solutions but focuses on customizing finance AI to suit individual operating processes and business goals.

Leading team of experts in the field of financial technology

STS Software brings together a team of experts with extensive experience in both finance and AI for finance. The ability to integrate expertise with advanced technology helps us develop financial artificial intelligence systems that are highly practical and bring long-term efficiency.

Professional service – Security – Efficiency

From the implementation process to operation, STS Software is committed to delivering professional AI in financial services, strictly adhering to data security standards and full regulatory compliance. The artificial intelligence finance systems we deploy always ensure performance, stability, and flexible scalability according to business needs.

Long-term companionship – Optimizing the system through each development stage

Not only stopping at deployment, STS Software is committed to accompanying partners throughout the operation of AI finance systems. We continuously monitor, adjust, and upgrade financial AI solutions to adapt to changes in the financial market and the strategic needs of businesses.

AI in finance is reshaping the entire way the financial industry operates – from internal operations, risk management, to customer care and investment. Artificial intelligence in financial services offers huge opportunities for businesses that are ready to change. STS Software is proud to be a pioneer accompanying you on this digital transformation path – effective, sustainable, and outstanding.